Along the margins – 2nd quarter, 2025

When we hear investors talk about their portfolio or favourite investment ideas, they’re natural optimists. They often focus on the potential upside of their investments – views on a business’ exciting prospects and why the investment will drive outsized returns in their portfolio. As a credit investor, I find my thoughts begin to drift during these conversations towards questions about why those positive outcomes might not happen or may take longer than expected to occur. Call me the pessimist in the room but I can’t help noticing that whenever investors talk about “risk-adjusted returns,” they never specify what “risk adjustments” are being made!

At EdgePoint, we define risk as the permanent loss of capital. We don’t define risk as price volatility like some finance textbooks would. We embrace volatility – it creates opportunities for us to take advantage of mispricings that allow us to buy future growth for free, and to position our Portfolios for greater go-forward returns. We believe that understanding the potential risks of an investment are just as important as understanding the possible rewards. Don’t just take our word for it. Warren Buffett once said:

“The first rule of an investment is: don’t lose. And the second rule is don’t forget the first rule.” i

I believe Buffett’s rules are doubly important for credit investors. Our upside is capped at receiving our principal back at the end of the investment period, plus the contracted coupon payments along the way. However, our downside can be the entirety of the capital we decide to lend to a company. You can see why a focus on risk is so important!

Every time we make an investment, we analyze the associated risk – what are the odds that we will experience a permanent loss of capital? We conduct a pre-mortem to discuss what could go wrong with an investment, why our idea might not play out, and what the business would look like if we’re wrong about our expected positive change in the business.

Following the rules

At EdgePoint, there are two primary steps we take to ensure we protect our end investors’ capital. The first is we keep things simple by sticking to the same investment approach we’ve been using since inception. Our investment approach focuses on looking for positive change occurring in a business that currently isn’t being recognized by the market. This is what gives us the opportunity to buy future growth for free. This seems more intuitive when it comes to equities, but our approach isn’t really different on the credit side. We’re looking for insights about changes to a business that could improve its ability to repay us during the period of time we’re lending to this business, but those positive changes aren’t being reflected in the bond’s price today. Some ways that businesses can improve on their ability to repay us include:

Growing organic revenue or expanding into new markets

Expanding margins via pricing power or finding cost efficiencies

Decreasing capital intensity after completion of a growth project, which ultimately improves free cash flow

Exploiting hidden asset value such as a segment that had previously burned cash flow, but is now slowly turning around to become a positive contributor of free cash flow

You will notice almost all these examples could also be insights for buying an equity! We keep things simple by looking for 40 to 45 businesses where we have insights on their improving ability to repay us as lenders, and ensure that we’re diversifying by business idea when constructing our Portfolios. We aren’t concerned with trying to look like an index, making interest rate calls or focusing on opinions from third-party rating agencies. By sticking to our approach, we hope to minimize risk by finding businesses that are improving their earnings power – the more cash flow a business can generate, the more easily it can repay its debts.

The second step we take to protect capital is to ensure there’s a comfortable margin of safety in the business, in case our insight doesn’t play out. While we hope that all our insights prove to be correct and play out as we initially envision, we understand it’s inevitable that we will occasionally be wrong. What we want to ensure is that your downside is protected even in these circumstances.

The main difference between equity and credit investments is what provides the latter with an additional margin of safety: the contractual nature of fixed income returns. An equity investment is an ownership stake of a company that participates in the upside of any growth, but also to the downside should the business decline. On the other hand, a credit investment is a contractual relationship where the investor is entitled to coupon payments for the term of the loan and the principal repayment at maturity.

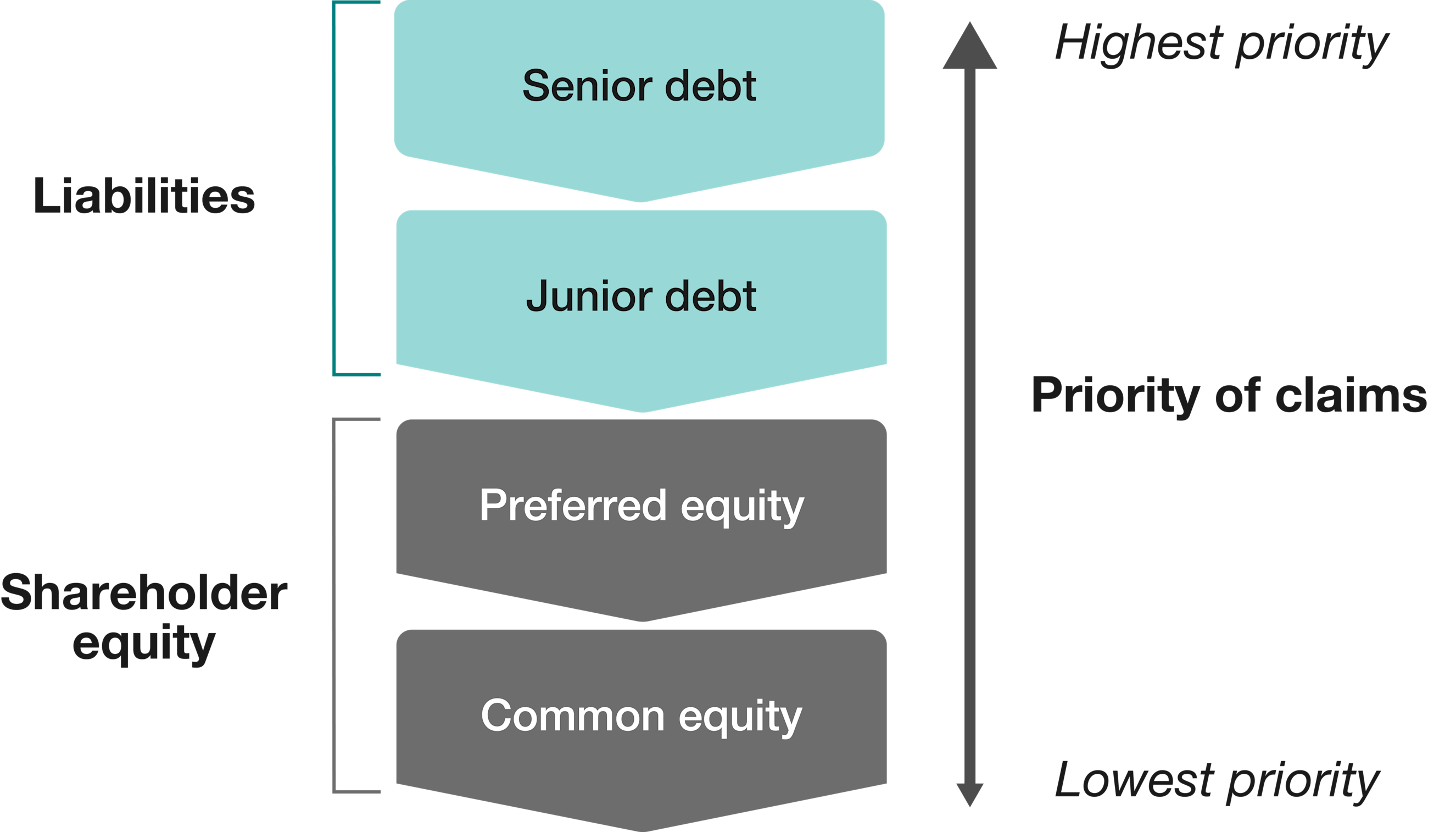

Credit offers an additional margin of safety if the borrower can’t meet its contractual obligation. In a worst-case scenario (i.e., the company‘s assets are liquidated), debtholders are entitled to priority in repayment ahead of shareholders. A creditor’s margin of safety is the equity value of the business and any junior debt. Before we see a loss when we lend to a company, the value of the equity and junior debt would first need to go to zero. A company’s equity can see a 100% decline and the debtholders can still earn a pleasing return from the previous coupon payments and the return of their capital! As credit investors, an important part of our analysis is having a view on what the business is worth if our insight doesn’t play out as expected. If we run through our pre-mortem and stress test the business under several pessimistic scenarios and still feel comfortable that our debt would be covered, chances are there is a solid margin of safety in the investment.

At EdgePoint, investing in credit expands the universe of businesses where we can apply our investment approach. Businesses where we feel we may have an insight but deem the risk too great for an equity investment may be a suitable credit investment, given the greater margin of safety from being higher in the capital structure.

Capital structure 101

A company funds its growth and operations using equity and debt. In case of a company bankruptcy, securities higher in the capital structure have a priority claim in getting repaid.

A Farfetch-ed scenario

Our investment in Farfetch Ltd.’s term loan is a good example of an investment where the margin of safety not only protected our end investor’s capital, but also allowed us to earn a pleasing return across our credit Portfolios.ii

Farfetch is an ecommerce marketplace for the luxury goods industry. Think of the business as the “Amazon of Luxury” – connecting brands and boutiques selling Cartier, Louis Vuitton and Gucci products to consumers. The business had its initial public offering (IPO) in 2018 and was considered a “unicorn,” reaching a peak valuation of over US$26 billion in market cap in 2021.iii We spent some time studying Farfetch as an equity idea as a result of our experience owning Compagnie Financière Richemont S.A. (“Richemont”),ii the owner of luxury brands such as Cartier and Van Cleef & Arpels. Over the past 20 years, Richemont had invested more than US$5 billion building out Farfetch’s largest luxury ecommerce competitor, YNAP (Yoox Net-a-Porter). A successful luxury ecommerce marketplace was the vision of Richemont’s founder and Chairman Johann Rupert, but the market wasn’t happy with its continued operating losses impacting the bottom line of the consolidated business. In August 2022, Richemont decided to throw in the towel on its ecommerce experiment and merge YNAP with Farfetch, taking back 53 million shares of Farfetch and convertible debt as a return.

Our insight about the business focused on a much smaller segment that Farfetch operated called Farfetch Platform Services (FPS), a software provider to brand websites. FPS operates the backend of websites like Cartier.com, and also manages online sales, customer service and inventory/logistics in exchange for a 15 to 20% take rate on website sales. As a part of the merger, Richemont would move all their brands to FPS over time. While we viewed this as a potential major driver of earnings outside of its primary marketplace business, we ultimately passed on investing in the equity because, while the idea was big, the core segment was still burning cash. We were also concerned because the Richemont deal was going through a year-long European antitrust review, and at the time we saw a potential bubble in online luxury sales as a major risk.

The idea had a second chance in September 2022, when we learned that Farfetch was looking to raise a senior secured term loan of up to US$600 million to help bridge the business until the YNAP deal closed. Given the non-siloed nature of our Investment Team, we were able to quickly form a view on the proposed debt issuance. We saw an opportunity to lend money to this business based on our initial insight on FPS’ potential and the Richemont partnership, but with a much larger margin of safety derived from being higher in the capital structure.

There was more cash than debt on the balance sheet at the time of the deal, and our debt would be first in line to be repaid. Behind our position in the capital structure was US$1 billion of convertible bonds and US$4 billion of market cap held by shareholders. Even if that US$5 billion of value declined to zero, Farfetch had US$1 billion of cash on hand along with over US$400 million of inventory and US$500 million of receivables on its balance sheet that could be liquidated at a discount. All of this would need to be burned through before we would see an impairment in our loan. This gave us comfort in our margin of safety despite our concerns around the core marketplace business.

The next 12 months proved difficult for the business. Farfetch went through its cash quickly owing to poor inventory management. Management had decided to invest in first-party brands alongside the company’s marketplace, which used even more of the available capital. As the luxury market slowed, the cost of holding inventory burned cash quickly. The market lost confidence in management and eventually the creditors took control of the business. Coupang, the dominant ecommerce marketplace of Korea, came in and injected US$500 million of capital into the business. Coupang saw value in the company’s brand and customer base, seeing an opportunity to enter the luxury marketplace with Farfetch. Coupang found value off the balance sheet in non-tangible assets ultimately worth over a half-billion dollars, further adding to our margin of safety.

Although our insight around the FPS business increasing earnings didn’t play out in the end, we were able to exit our investment with a pleasing return. In this case, we were wrong about our insight on Farfetch improving its ability to repay us during our holding period, but our analysis of the margin of safety ultimately protected our capital and allowed us to achieve a positive outcome.

Farfetch Ltd. term loan (internal rate of return) vs. the high-yield index (total annualized returns)

A half-full glass

We will be first to admit when we’re wrong about our insights – we understand that no investor has a perfect batting average. Our approach helps us to ensure that our investors’ downside is protected whenever we take a swing. Since EdgePoint’s inception, we have made more than 700 credit investments. Eight of those investments resulted in defaults, with six of those defaults resulting in a positive return and two which had a loss. Investors in our credit Portfolios can sleep well knowing that the Investment Team is constantly looking to protect their capital and is investing with Buffett’s first and second rules at the top of mind.