Finding opportunity in uncertainty – 1st quarter, 2025

Investing is analogous to planning a journey. You know where you are today (“Point A”) and where you want to go (“Point B”), whether that be retirement, a new home, funding education or other financial goals. However, the path between Point A and Point B rarely looks like a straight line on a map. Today, it seems particularly winding, doesn’t it? Investors are navigating a landscape filled with uncertainty – tariffs, geopolitical tensions, consumer boycotts and disruptive new technologies just to name a few of the pressing concerns.

It’s natural to wish for a clearer outlook and smoother ride. But just like life’s little detours often lead to unexpected adventures, investing requires embracing the bumps in the road rather than fearing them. To get from Point A to Point B, we believe investors need to embrace the uncertainty.

Looking back – uncertainty is nothing new

If today feels uniquely uncertain, a quick look back reminds us that every decade brings its own set of challenges. The investment approach we apply at EdgePoint has been utilized for over 50 years at different firms through a variety of economic and market conditions. Despite the noise, embracing uncertainty, rather than avoiding it, has historically helped people reach their Point B.

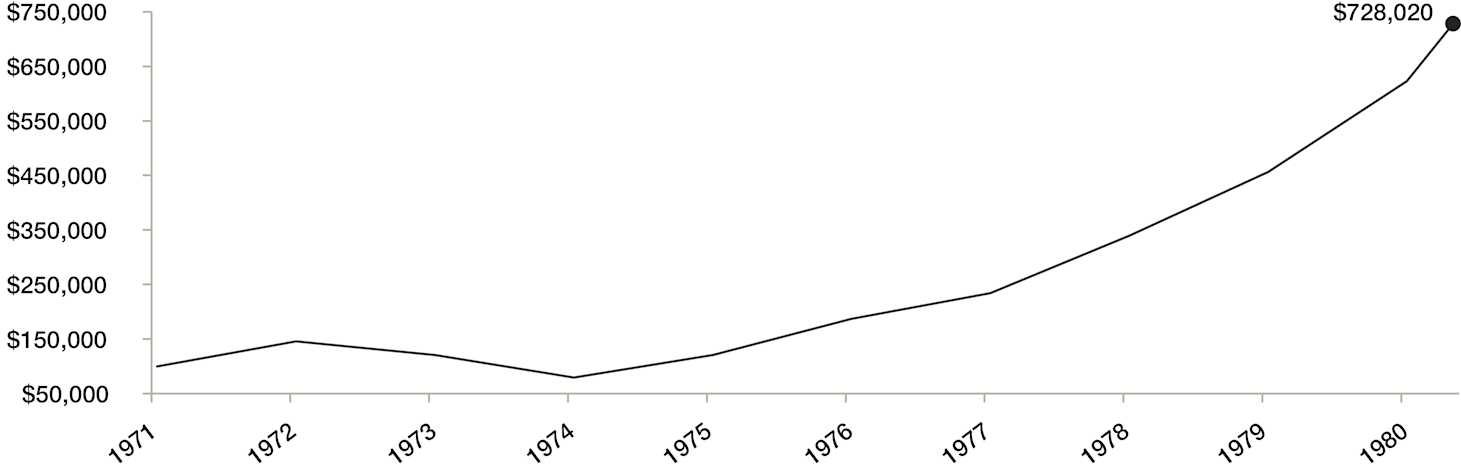

The 1970s – Taurus Fund

Remember stagflation? This challenging decade brought slow growth, high inflation, an oil crisis that sent energy prices soaring and a significant stock market downturn (the “Nifty Fifty” darlings stumbled).i The Dow Jones Industrial Average lost over 45% between early 1973 and late 1974.ii Investors who ignored their emotions and entrusted their money to the Taurus Fund (launched in 1971 and co-managed by an EdgePoint co-founder until 1981) were rewarded for embracing uncertainty and getting closer to their Point B.

Taurus Fund, Series FE – growth of $100,000

Dec. 31, 1971 to Apr. 30, 1981

Source, Taurus: Bolton Tremblay Funds Inc. 1982 Annual Report. Total annual returns measured in C$. Historical performance is not indicative of future returns. The Taurus Fund is used for illustrative purposes only to demonstrate the history of the investment approach applied at EdgePoint. The period selected covers the launch of the Taurus Fund to the year Robert Krembil, one of EdgePoint’s co-founders, left to start Trimark Financial Corp.

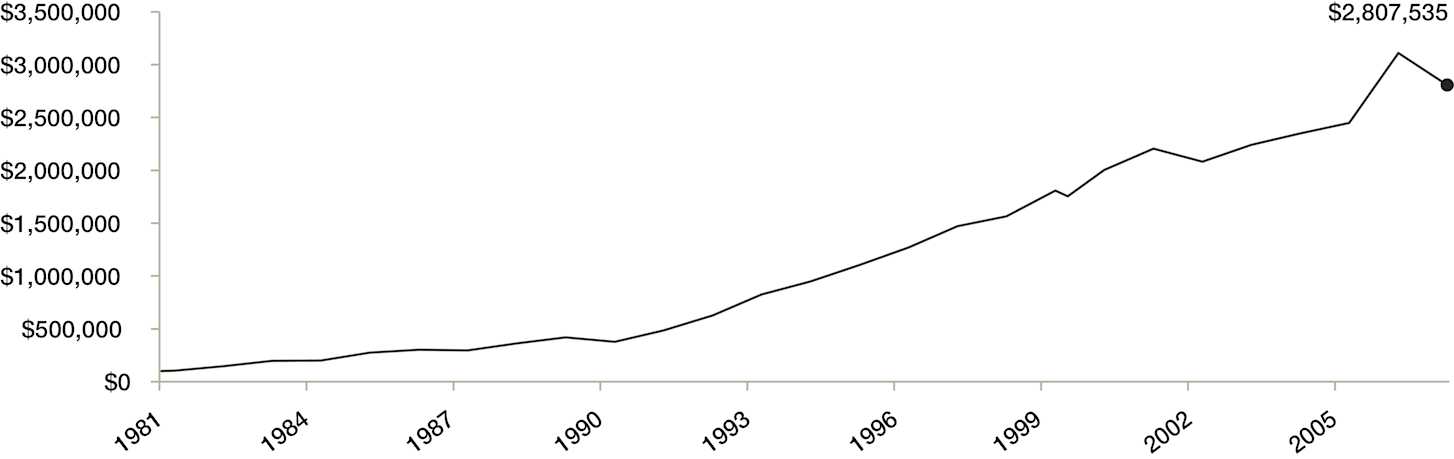

The 1980s to the mid-2000s – Trimark Fund

1980s – started with a tough recession and sky-high interest rates needed to fight the inflation leftover from the 70s; the “Black Monday” crash in 1987 saw markets plunge dramatically in a single day

1990s – kicked off with a recession partly fueled by Iraq’s invasion of Kuwait (causing oil prices to spike); followed by the build-up of the tech bubble, with excitement running high but setting the stage for a subsequent fall

2000s – known as a “lost decade” for stocks by some, this period saw the bursting of the dot-com bubble early on (we’ll talk later about the Global Financial Crisis (GFC) that shook confidence worldwide)

Investors who ignored their emotions and entrusted their money to the Trimark Fund (launched in September 1981, again by an EdgePoint co-founder) during its first two-and-a-half decades were rewarded for embracing uncertainty and getting closer to their Point B.

Trimark Fund, Series SC – growth of $100,000

Sep. 1, 1981 to Dec. 31, 2007

Annualized total returns, net of fees, in C$. As at December 31, 2007 (period end).

Trimark Fund, Series SC – 10-year: 6.67%, 5-year: 6.17%, 3-year: 6.12%, 1-year: -9.70%

Source: Morningstar Direct. As at July 27, 2018, Trimark Fund changed its name to Invesco Global Companies Fund. The above values are for illustrative purposes only and do not represent an actual client’s results. Total annual returns measured in C$. Historical performance is not indicative of future returns. The Trimark Fund was used for illustrative purposes only to demonstrate the history of the investment approach applied at EdgePoint. The period selected covers the launch of the Trimark Fund to the year prior to EdgePoint’s launch. It includes the events mentioned from the 1980s to 2000s.

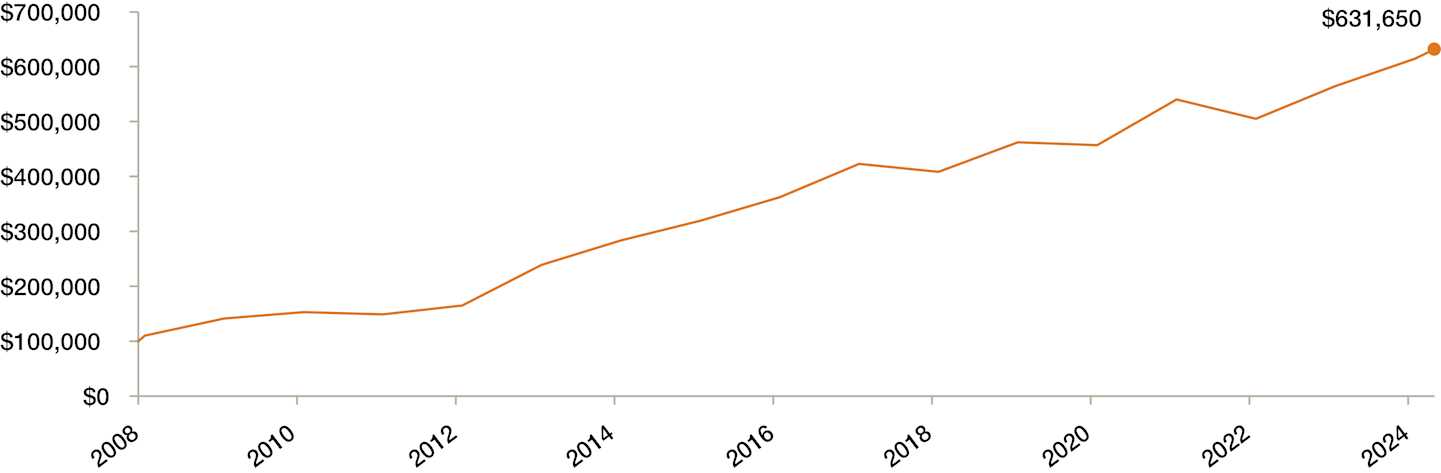

The late 2000s, 2010s and 2020s (so far) – EdgePoint Global Portfolio

The recovery from the GFC dominated the early part of the 2000s, mixed with concerns about things like the European debt crises. Despite being just more than halfway through, this decade has already delivered significant uncertainty. It began with the unprecedented COVID-19 pandemic, which caused a sharp market crash in early 2020 and triggered a global recession. This was followed by major supply chain disruptions, a surge in inflation to levels not seen in decades (as well as rapid interest rate hikes by central banks to combat this inflation) and heightened geopolitical uncertainty. The most notable example of the latter is the ongoing war in Ukraine, which has impacted energy prices and global stability.

We understand that this can feel uncomfortable but know that adhering to the investment approach we practice today has helped investors who ignored their emotions. Those who entrusted their money to the EdgePoint Global Portfolio were rewarded for embracing uncertainty and getting closer to their Point B.

EdgePoint Global Portfolio, Series A – growth of $100,000

Nov. 17, 2008 to Mar. 31, 2025

Annualized total returns, net of fees, in C$. As at March 31, 2025.

EdgePoint Global Portfolio Series A – Since inception (Nov. 17, 2008): 11.92%, 15-year: 10.14%, 10-year: 7.08%,

5-year: 12.55%, 3-year: 7.75%, 1-year: 5.59%, YTD: 2.80%.

The above values are for illustrative purposes only and do not represent an actual client’s results. Total annual returns, net of fees, measured in C$. Historical performance is not indicative of future returns. The period selected begins with the EdgePoint Global Portfolio’s inception.

Through all these periods of unease – recessions, crises, booms and busts – the market ultimately moved forward. Owning businesses that embraced change during uncertainty proved rewarding for long-term investors focused on their Point B.

The high price of predictability

It’s human nature to crave certainty. We like routines and predictable outcomes. This desire often spills into investing, where people understandably gravitate towards companies that seem like “sure things” – the obvious growers or the perceived safe havens.

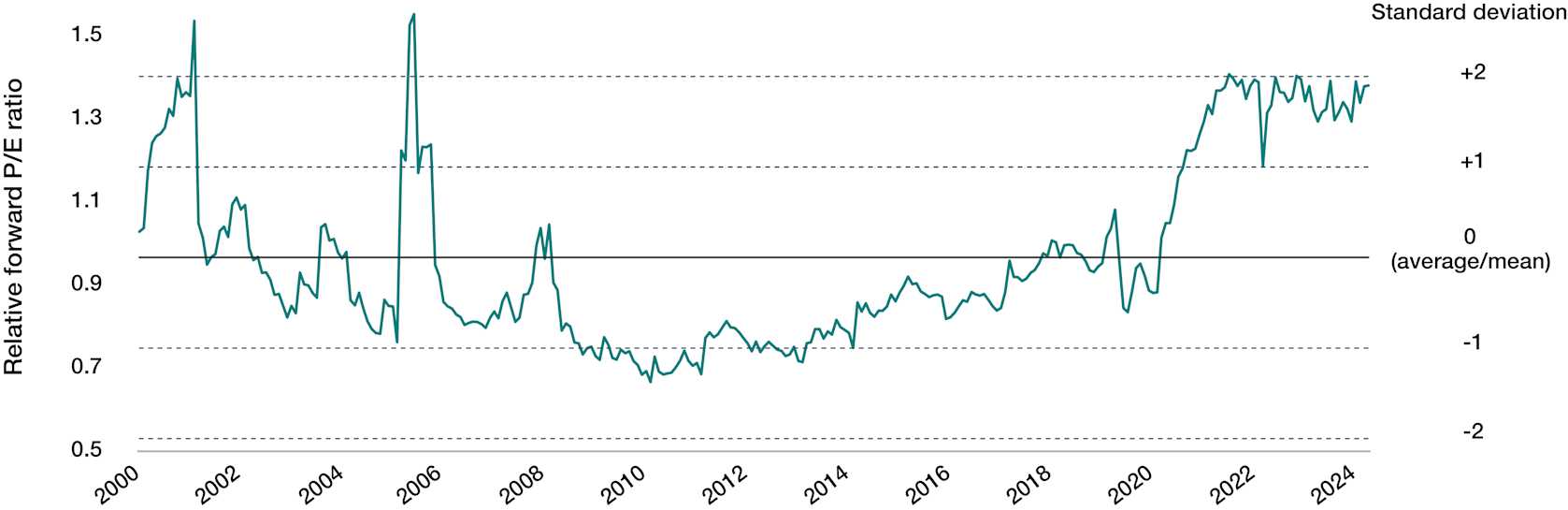

However, history shows that paying a premium for this perceived certainty can be costly. Valuations for the most popular and largest “growth” stocks can reach extreme levels. Investors have paid high prices for obvious growth in the past (like the Nifty Fifty or the dot-com darlings), often leading to disappointing returns later when reality set in or the world changed. Today, many large, popular, obvious-growth companies trade at significant valuation premiums compared to historical averages and relative to less-obvious, still-growing, mid-sized companies. The takeaway? Chasing certainty can be expensive; embracing well-researched uncertainty might be more rewarding. We have a strong preference for the latter.

S&P 100 Index vs. S&P MidCap 400 Index – relative forward P/E ratio

Dec. 2000 to Mar. 2025

Source: Bloomberg LP. As at March 31, 2025. All figures in US$. The relative forward P/E ratio is calculated by dividing the S&P 100 forward P/E ratio by that of the S&P MidCap 400 Index. The indexes are not investible.

Forward P/E is based on the consensus estimates for the next four quarters. Standard deviation is a measure of volatility that shows how dispersed values are from the average. The S&P 100 Index is an index comprised of the 100 largest U.S. companies based on market capitalization. The S&P MidCap 400 Index is an index comprised of the mid-range 400 U.S. companies based on market capitalization.

Our approach – rolling up our sleeves

At EdgePoint, we don’t shy away from uncertainty; we lean right into it. Our investment approach, consistent for over 50 years, involves looking for businesses undergoing significant change, often when the economic backdrop is rocky, or a company itself is navigating a transformation.

Finding these opportunities isn’t about gazing into a crystal ball. It’s about diligent, on-the-ground research. As highlighted in our commentary from the last quarter of 2024, our Investment Team members travel the globe, visiting factories, touring facilities, meeting management teams, talking to customers and suppliers – doing the detailed work to understand a business deeply. We look for a “proprietary insight” – seeing positive change or potential that the wider market might be overlooking or underappreciating because of near-term uncertainty.

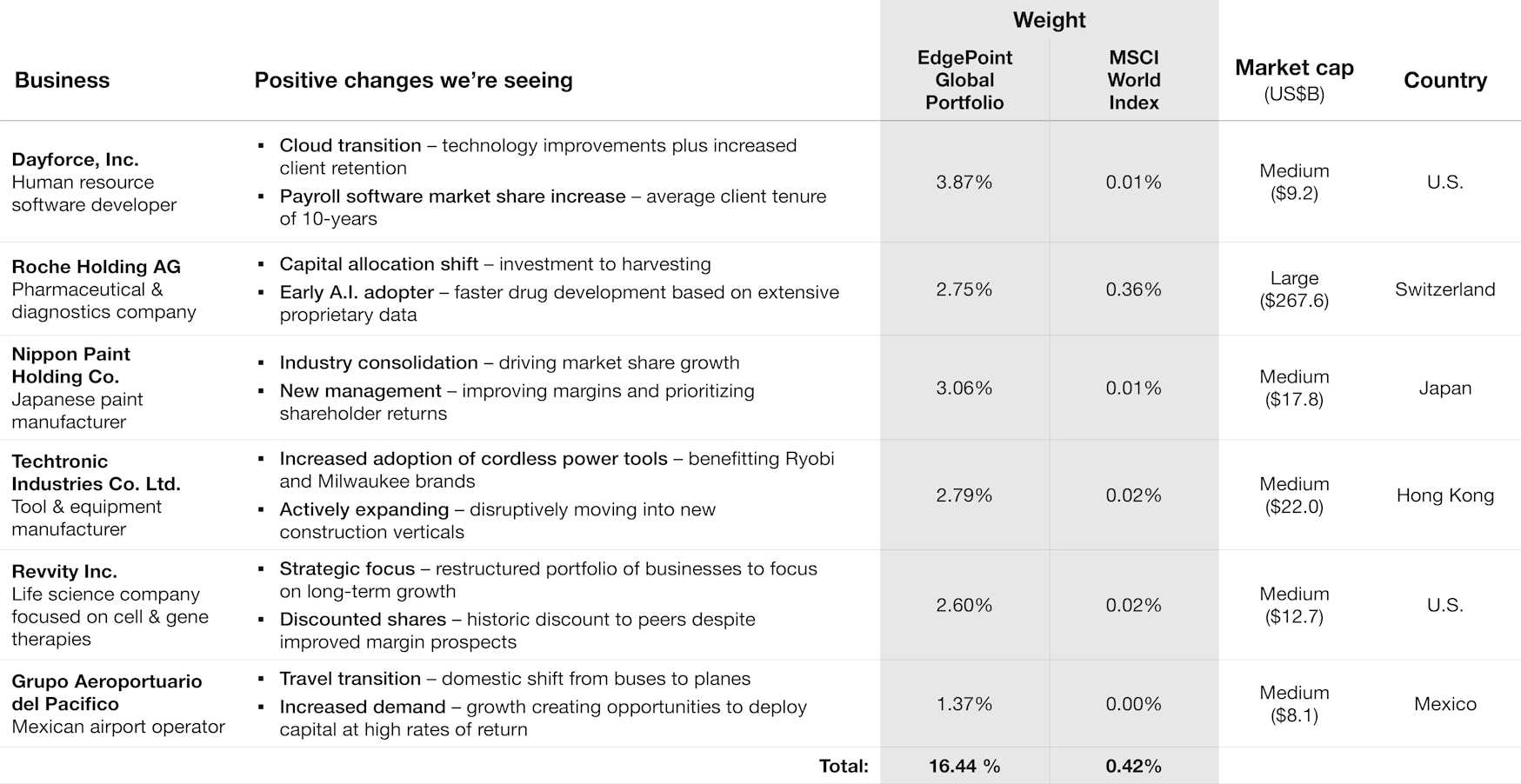

Below are six more-recent business ideas that comprise about 15% of the EdgePoint Global Portfolio that we have uncovered through our diligence process. These are businesses navigating profound change, offering opportunity for investors willing to look beyond the immediate uncertainty. It’s this willingness to embrace change and uncertainty that guides our search for investment ideas.

Examples of positive change in EdgePoint Global Portfolio

As at Mar. 31, 2025

Source: FactSet Research Systems Inc. As at March 31, 2025, the above companies’ securities are held in EdgePoint Global Portfolio and/or other EdgePoint Portfolios/Cymbria. See Important information – Portfolio companies for additional details.

Insights are based on the proprietary research performed by the EdgePoint Investment Team. Information on the above securities are solely to illustrate the application of the EdgePoint investment approach and not intended as investment advice. They are not representative of the entire portfolio, nor is it a guarantee of future performance. EdgePoint Investment Group Inc. may be buying or selling positions in the above securities. The MSCI World Index is a broad-based, market-capitalization-weighted index comprising equity securities available in developed markets globally. The index is not investible. We manage our Portfolios independently of the indexes we use as long-term performance comparisons. Differences including security holdings and geographic/sector allocations may impact comparability and could result in periods when our performance differs materially from the index. The index was chosen for being a widely used benchmark of the global equity market.

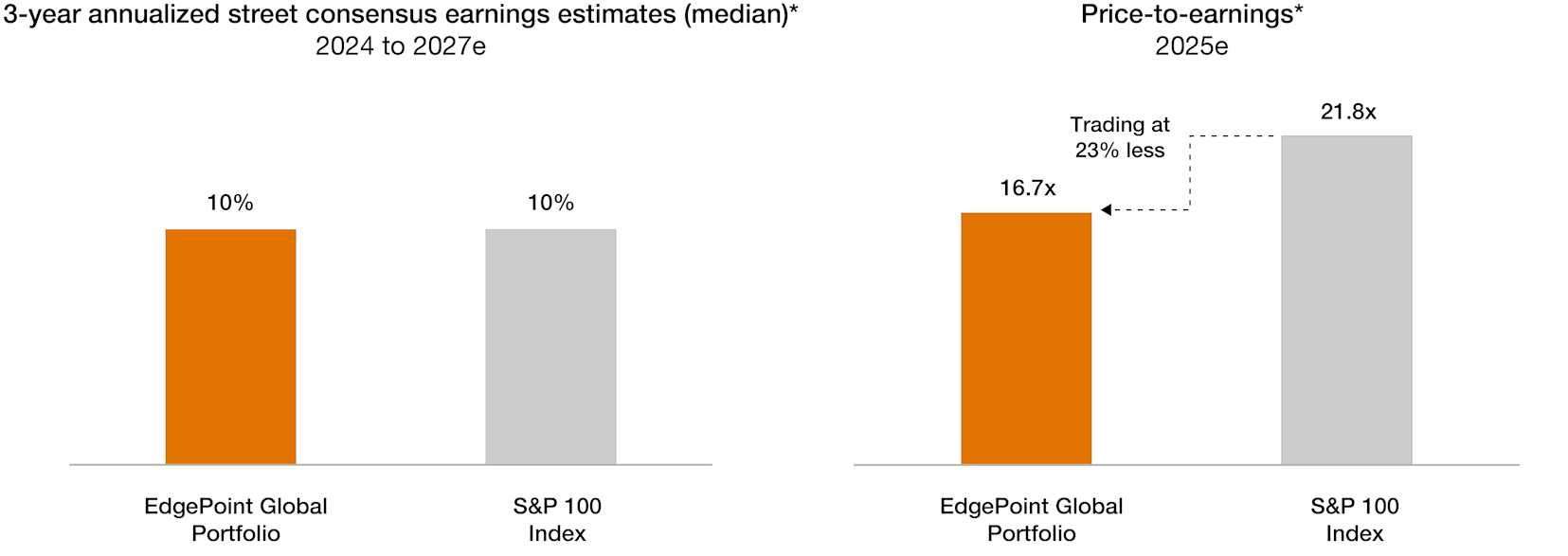

Uncertainty can create opportunity – growth without paying for it

Why embrace uncertainty? Because buying businesses when unrecognized change is profound – both at the company level and within the broader economy – can create favourable investment conditions. It allows us the opportunity to buy into potential future growth without paying the high price often demanded for certainty.

The EdgePoint Global Portfolio reflects this approach today. It’s composed of businesses that we believe have unrecognized growth potential, often because they’re navigating change or operating in less-followed corners of the market. Currently our Portfolio is largely invested in medium-sized companies that are trading at a considerable valuation discount compared to the largest, most popular companies, yet we believe they offer compelling growth prospects. Our willingness to look different means that despite similar future growth estimates, the businesses in the Portfolio are trading at a more-than-20% discount relative to those market darlings. By focusing on the underlying value and long-term potential, rather than just the current sentiment, we aim to position the portfolio to capture “growth without paying for it”.

Annualized total returns, net of fees (excluding advisory fees), in C$.

EdgePoint Global Portfolio, Series F – Since inception (Nov. 17, 2008): 13.34%; 15-year: 11.40%; 10-year: 8.30%, 5-year: 13.84%, 3-year: 8.98%, 1-year: 6.80%, YTD: 3.09%

S&P 100 Index - Since EdgePoint inception (Nov. 17, 2008): 15.70%; 15-year: 16.33%; 10-year: 15.15%, 5-year: 20.05%, 3-year: 16.08%, 1-year: 17.57%, YTD: -6.05%

A weighted harmonic average was used to calculate the price-to-earnings ratios. Businesses without 2027 street-consensus earnings estimates were excluded from all calculations. 11% of EdgePoint Global Portfolio and 1% of S&P 100 Index names were excluded due to negative 2024 consensus estimates or a lack of 2027 consensus earnings estimates. While the S&P 100 Index is not the official benchmark for the EdgePoint Global Portfolio, it was used for comparative purposes because it includes the 100-largest U.S. businesses, which are also among the most widely discussed companies globally. These businesses also represent a significant weight in the MSCI World Index, the official benchmark for the EdgePoint Global Portfolio. The MSCI World Index is a market-capitalization-weighted index comprising equity securities available in developed markets globally. We manage our Portfolios independently of any indexes we use as long-term performance comparisons. Differences such as security holdings and geographic/sector allocations may impact comparability from the index.

* As at March 31, 2025, 2024 earnings use reported results when available and estimates when reports haven’t been released.

Source: FactSet Research Systems Inc. As at March 31, 2025. The indexes are not investible.

Staying the course

This approach – embracing uncertainty and focusing on long-term business value – isn’t new. It was conceived by our co-founder Robert Krembil and has been applied consistently for over half a century and through numerous market cycles. As the historical performance charts shared earlier illustrate, this disciplined approach has delivered pleasing results over the long term.

Today, over 300,000 Canadians entrust us with their hard-earned savings to help them get from their Point A to their Point B.iii We are incredibly thankful for that privilege and remain committed to the disciplined, research-driven approach that has served our investors well over time.

Thank you for your continued trust. We work hard every day to be worthy of it.

As at March 31, 2025, securities issued by the following companies were held in EdgePoint Portfolios and/or Cymbria – Dayforce, Inc., Roche Holding AG, Nippon Paint Holding Co., Techtronic Industries Co., Ltd. and Revvity, Inc. (EdgePoint Global Portfolio, EdgePoint Canadian Portfolio, EdgePoint Global Growth & Income Portfolio, EdgePoint Canadian Global Growth & Income Portfolio and Cymbria); Grupo Aeropuerto del Pacifico (EdgePoint Global and EdgePoint Global Growth & Income Portfolio). Information on the above companies’ securities is not intended as investment advice. They are not representative of the entire portfolio, nor is it a guarantee of future performance. EdgePoint Investment Group Inc. may be buying or selling positions in the above securities. Past performance is no guarantee of future results.

i The “Nifty Fifty” was a loose grouping of the 50 most traded large-capitalization stocks on the New York Stock Exchange in the 1960s and 1970s.

ii Source: “Shadow of ‘70s Bear Looms, but Was It Really as Bad as We Think?”. The Los Angeles Times. November 3, 1996. Decline period was January 11, 1973 to December 6, 1974. Returns in US$. The Dow Jones Industrial Average, or simply the Dow, is a stock market index tracking the stock price of 30 large, publicly owned companies based in the United States over different periods of time. The Dow is not investible.

iii As at March 31, 2025.