The art of portfolio managing (expectations) – 1st quarter, 2025

The most common question I usually receive from advisors is some variation of “What returns can I expect from the credit Portfolios?” Some believe that the mathematical nature of fixed income allows us to conjure a certain return in a very uncertain world. In reality, the perceived “precision” that comes from a stated yield-to-maturity (YTM) for a bond or portfolio is misplaced. If it were truly predictable, the rate would be no higher than its risk-free counterpart and there would be no need for myself or the rest of the EdgePoint Investment Team.

Clients often ask the question about expected returns as they think it will help them time the market, buying only when yields are high. The current price and the resulting yield certainly influence your future return but they can be poor signals. Relying on false and misplaced precision often leads to investors outsmarting themselves and missing future opportunities that can’t be forecasted or predicted.

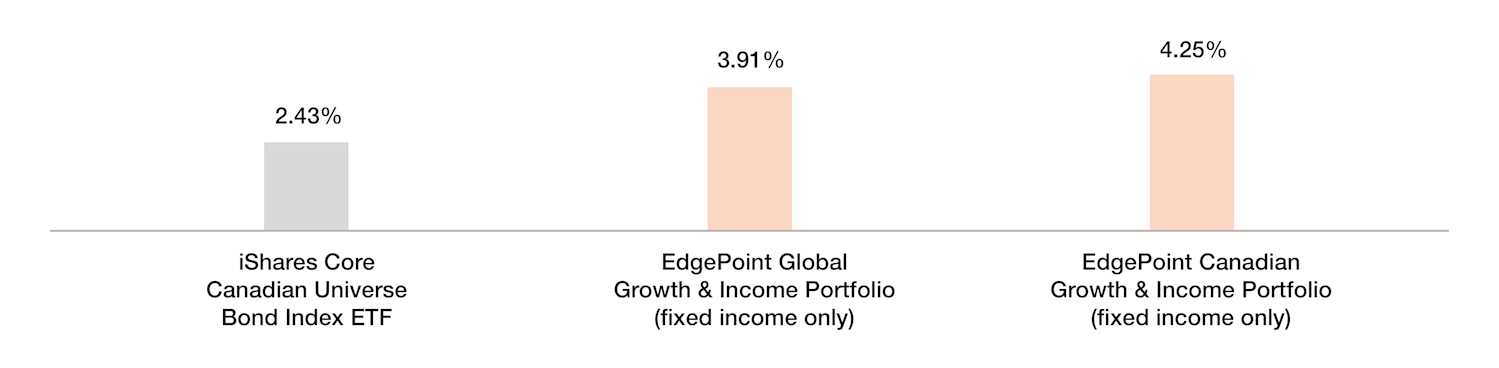

Investors could be wildly disappointed if they believe that the future return of their fixed-income portfolio is simply the YTM at the time of purchase. Here’s an example to illustrate how actual returns can deviate. Going back to the start of 2020, let’s compare the yield of the investment-grade opportunity set at the time (represented by a commonly used benchmark showing a broad mix of both government and corporate bonds) and the fixed-income portion of our EdgePoint Growth & Income Portfolios:

EdgePoint Growth & Income Portfolios vs. investment-grade ETF – YTM (local currency)

As at Jan. 1, 2020

Portfolio performance as at March 31, 2025. Annualized total returns, net of fees (excluding advisory fees), in C$.

EdgePoint Global Growth & Income Portfolio, Series F - Since inception (Nov. 17, 2008): 11.21%, 15-year: 9.66%,

10-year: 7.28%, 5-year: 11.73%, 3-year: 8.24%, 1-year: 6.98%, YTD: 2.12%.

EdgePoint Canadian Growth & Income Portfolio, Series F - Since inception (Nov. 17, 2008): 11.47%, 15-year: 9.31%,

10-year: 9.05%, 5-year: 18.53%, 3-year: 11.10%, 1-year: 10.66%, YTD: 0.61%.

iShares Core Canadian Universe Bond Index ETF - Since EdgePoint inception (Nov. 17, 2008): 3.33%,

15-year: 2.96%, 10-year: 1.61%, 5-year: 1.10%, 3-year: 2.41%, 1-year: 7.40%, YTD: 1.93%.

Yield-to-maturity is the total return anticipated on a bond if it’s held until it matures and coupon payments are reinvested at the yield-to-maturity. Yield-to-maturity is expressed as an annual rate of return. Series F is available to investors in a fee-based/advisory fee arrangement and doesn’t require EdgePoint to incur distribution costs in the form of trailing commissions to dealers. While not our benchmark, the iShares Core Canadian Universe Bond Index ETF is a commonly used representative of investment-grade markets. We manage our Portfolios independently of the indexes we use as long-term performance comparisons. Differences including security holdings and geographic/sector allocations may impact comparability and could result in periods when our performance differs materially from the index. Additional factors such as credit quality, issuer type and yield may impact fixed income comparability from the index.

Source: Bloomberg LP. As at January 1, 2020. See Important information – Benchmarks and indexes for additional details.

Think back to that time. Most of us hadn’t even heard of COVID-19 yet and would never have been able to predict the capital market’s rollercoaster ride that came over the next five years. Portfolios had to contend with inflation for the first time in years, supply-chain disruptions, the start of kinetic wars in Europe and the Middle East, trade wars, an explosion of A.I./potential technological disruptions and shifting political winds across the globe. While this list certainly isn’t exhaustive, it does highlight how quickly things can change and how your portfolio must be ready to adapt to these changes.

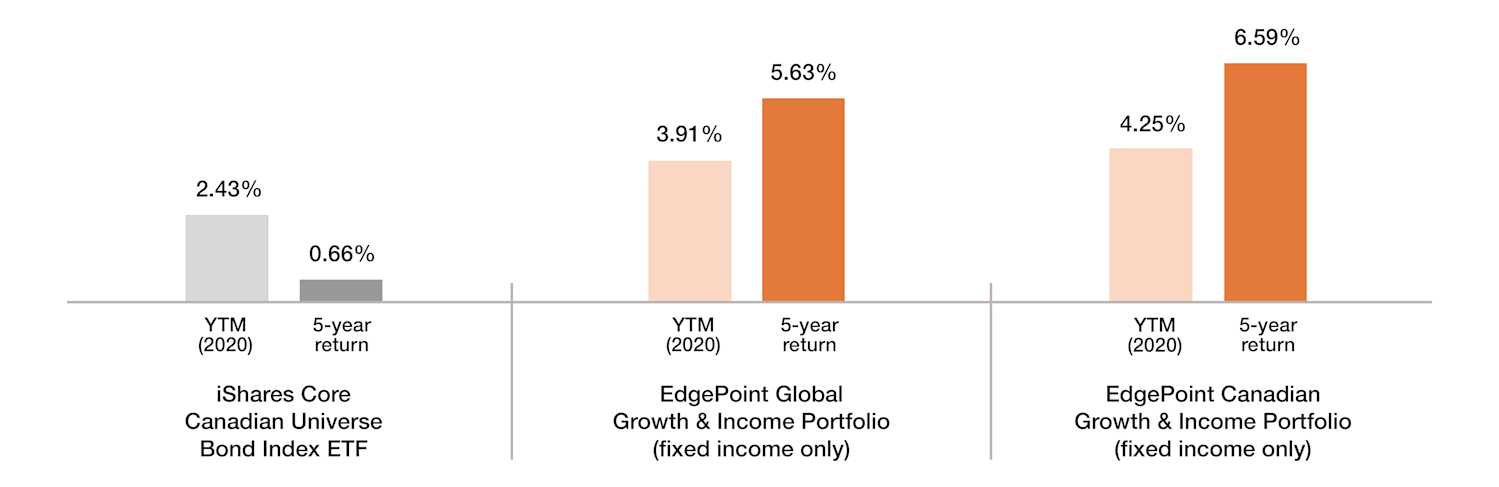

An index doesn’t adapt. It has a set of rules that it lives by regardless of the environment around it. Some would tout its rules-based framework as a selling feature but I would argue that it’s a bug. It’s a bug because you can do better. Unlike an index, you can take advantage of the volatility that’s created during these periods, choosing to invest when you think the market is trading more on emotions than fundamentals. Look at how well those YTMs predicted their returns five years later:

EdgePoint Growth & Income Portfolios vs. investment-grade ETF – YTM (Jan. 2020) and 5-year return (both in local currency)

As at Jan. 1, 2025

Hypothetical returns for fixed income only. They are not investible.

They’re a best-estimate of EdgePoint Growth & Income Portfolios’ fixed-income performance.

Portfolio performance as at March 31, 2025. Annualized total returns, net of fees (excluding advisory fees), in C$.

EdgePoint Global Growth & Income Portfolio, Series F - Since inception (Nov. 17, 2008): 11.21%, 15-year: 9.66%,

10-year: 7.28%, 5-year: 11.73%, 3-year: 8.24%, 1-year: 6.98%, YTD: 2.12%.

EdgePoint Canadian Growth & Income Portfolio, Series F - Since inception (Nov. 17, 2008): 11.47%, 15-year: 9.31%,

10-year: 9.05%, 5-year: 18.53%, 3-year: 11.10%, 1-year: 10.66%, YTD: 0.61%.

iShares Core Canadian Universe Bond Index ETF - Since EdgePoint inception (Nov. 17, 2008): 3.33%,

15-year: 2.96%, 10-year: 1.61%, 5-year: 1.10%, 3-year: 2.41%, 1-year: 7.40%, YTD: 1.93%.

Yield-to-maturity is the total return anticipated on a bond if it’s held until it matures and coupon payments are reinvested at the yield-to-maturity. Yield-to-maturity is expressed as an annual rate of return. Series F is available to investors in a fee-based/advisory fee arrangement and doesn’t require EdgePoint to incur distribution costs in the form of trailing commissions to dealers. While not our benchmark, the iShares Core Canadian Universe Bond Index ETF is a commonly used representative of investment-grade markets. We manage our Portfolios independently of the indexes we use as long-term performance comparisons. Differences including security holdings and geographic/sector allocations may impact comparability and could result in periods when our performance differs materially from the index. Additional factors such as credit quality, issuer type and yield may impact fixed income comparability from the index.

Source: Bloomberg LP. As at January 1, 2025. Returns shown for illustrative purposes only and aren’t indicative of future performance. The EdgePoint Growth & Income Portfolio fixed income returns are in local currency, net of fees and approximations calculated based on end-of-day holdings data (actual trading prices not captured). See Important information – Benchmarks and indexes and Important information – EdgePoint Growth & Income Portfolio fixed income returns for additional details.

Although I think those numbers are the ultimate sales pitch for active management, this commentary is more about forecasting future returns. In all cases, the YTM didn’t do an excellent job predicting the future 5-year performance. Our Portfolios materially outperformed by adapting to the changes in the market and using the volatility to our advantage. The indexes or those who chose to hug them didn’t have the same success.

So how should you think about future returns? It starts by defining the measurement timeframe. In my opinion, predicting future returns in several months or even several years is a mug’s game. You need to give yourself time to earn coupons and realize the price changes that can happen as bonds get closer to maturity. I previously highlighted the five-year performance for a reason, as I believe it’s a suitable timeframe to both set return expectations and judge a manager’s performance. When thinking about future return expectations you need to make sure they’re consistent with the investment approach and give the manager enough time to surface value. We believe five years is a good starting place for our approach because it gives us enough time to develop a differentiated view on a bond and see the thesis play out.

The income is fixed, the price and your returns aren’t

Volatility often drives down the price of bonds to below par. Our investment approach favours these situations for their potential yield and the capital gains that occur as bonds appreciate to par at maturity. The latter is a critical point to focus on – bond prices do change. While not as volatile as equities, the prices of bonds move based on a variety of factors, including the fundamentals of the debtor, macroeconomic conditions and general market sentiment. You should welcome this change. It’s the changing of prices that allows us to outperform a static basket of bonds as we scour the globe looking for opportunities. There’s no way to predict how or when these opportunities will arise, but you need to have confidence that we have a process and a structure to find and capitalize on them. Our 16-year track record is testament to that.

I reviewed the portfolio activity for the fixed-income portion of the EdgePoint Growth & Income Portfolios. Their fixed-income returns over the last five years came from a diverse set of companies behind those bonds.i The contribution to the portfolio’s performance was diverse. We didn’t make one large bet and hope to get it correct. Top return contributions came from:

Energy companies like Vesta and Calfrac

Retailers like Alcanna, Bath & Body Works, AutoCanada, and QVC Group

Industrial businesses like Cleaver Brooks

Consumer-facing businesses like Cineplex, Dave & Busters and Lindblad Expeditions

Healthcare businesses like DRI and Embecta

Chemical companies like Chemours

See Important information – Portfolio companies for additional details.

The list could be longer, but I hope you feel confident that your credit Portfolios are diversified.

We’re business analysts who aim to find unique opportunities where we believe the market is mispricing risk. These ideas are well researched based on our deep-dive fundamental approach and weighted appropriately in your Portfolios. The world is a complex place and we will not always be right, so diversification is crucial to our process. When I review the list of contributors over the last five years, I’m pleased with the broad sources of performance. Over that five-year period, the fixed income portion of EdgePoint Growth & Income Portfolios each held debt from about 175 issuers.ii

In January 2020, we couldn’t have predicted many of the catalysts that made these investments actionable. Embecta hadn’t been spun out of Becton Dickinson yet and didn’t exist in its current form. Management teams at energy companies were just starting to find religion, improving their balance sheet and making the sector more investible. COVID-19 hadn’t yet shut down industries that needed debt to make it through the pandemic like Cineplex or Dave & Busters. How do you incorporate events like this into future return prospects? You can’t, but you can ensure that you’re partnered with an investment firm like EdgePoint that has a track record and a process for capitalizing on these events.

A different kind of diversity

My other observation from that data is the diversity in style or structure of the investments. We have a lengthy list of bonds, loans, convertibles and even preferred shares. Some are rated high yield while others are investment grade, and we often find value in unrated bonds. A flexible mandate is a huge asset for investors. Flexibility allows an investor to focus on where they’re finding the best opportunities and not to be forced into an overfished pond. It should be no surprise that many of our contributors were high-yield debt, but I bet most clients wouldn’t guess that one of our top contributors to the Growth & Income Portfolios was an investment-grade bond. Convertible bonds were also a significant contributor and fit very well with our investment approach, while several preferred shares also generated strong returns.

Our primary skill set is analyzing businesses and identifying why investors are overestimating their risk. Using an approach that’s grounded in fundamental analysis, we aim to identify fixed-income investments that overpay us for their credit risk. When we identify an interesting business, our next step is to find the most attractive place in the capital structure to help capitalize on our view. Many companies have different debt instruments outstanding, and we have a distinct skill set of finding the security that we believe has the best risk/reward and can best complement the existing securities in the portfolio. Equity market volatility may lead to the convertible bond market providing the best opportunity set. Rising rates could put more pressure on bonds over loans, while idiosyncrasies in a company’s capital structure could drive deviations in one security relative to another. We can’t predict when one of these events will happen, but we can be prepared to take advantage of them when they do.

But…what returns can you expect from the credit Portfolios?

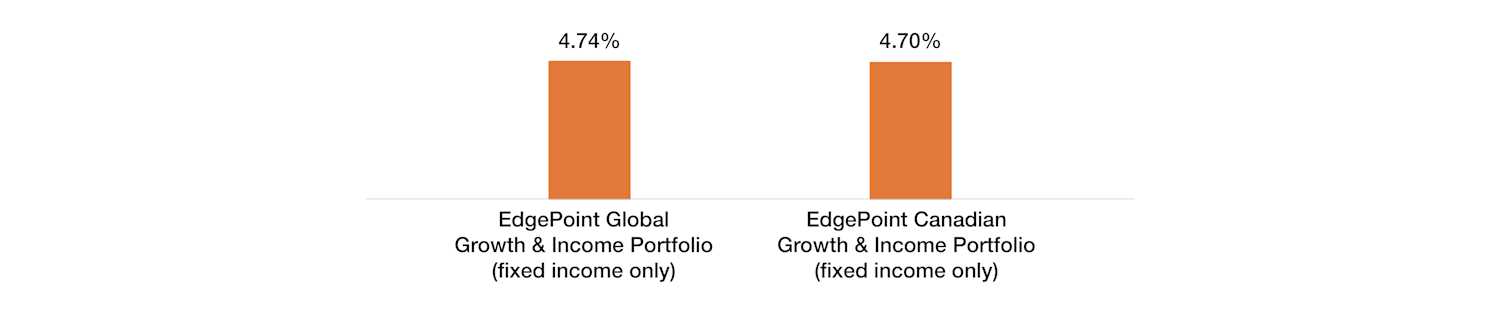

I have gotten this far without actually answering the opening question. What are our return expectations for the fixed-income portfolios? While I have already explained why the current YTM can be a wildly inaccurate predictor, it’s a good place to start. Take a look at the YTM on our Portfolios today:

EdgePoint Portfolios – YTM (local currency)

As at Mar. 31, 2025

Portfolio performance as at March 31, 2025. Annualized total returns, net of fees (excluding advisory fees), in C$.

EdgePoint Global Growth & Income Portfolio, Series F - Since inception (Nov. 17, 2008): 11.21%, 15-year: 9.66%,

10-year: 7.28%, 5-year: 11.73%, 3-year: 8.24%, 1-year: 6.98%, YTD: 2.12%.

EdgePoint Canadian Growth & Income Portfolio, Series F - Since inception (Nov. 17, 2008): 11.47%, 15-year: 9.31%,

10-year: 9.05%, 5-year: 18.53%, 3-year: 11.10%, 1-year: 10.66%, YTD: 0.61%.

The only prediction I can make about our future 5-year returns is that the odds of their returns matching today’s YTM are extremely low. Investing is centred on making a decision based on imperfect information. I believe that thinking probabilistically about future scenarios can help you make better decisions. In a world of three simple outcomes (matching, beating or returning less than our YTM), I think the odds are skewed. Our investment approach, structure and track record shift the results in our favour by allowing us to capitalize on opportunities that we can’t predict today but we believe have a high likelihood of occurring over the next five years. Similar to how we beat our YTM from 2020 to 2025, I believe we’re well positioned to do the same out to 2030. My confidence stems from how we’re positioned today and from the drivers of increased volatility.

The cash weights in all of our Portfolios are well above our historic average. My partner Derek wrote a great commentary, which you can read here, about how we view cash. While not making a market call, we chose not to invest in many of the refinancing opportunities that have occurred with our recent holdings. We had confidence in the debt, but we didn’t like the pricing. Rather than competing with perennially optimistic investors, we chose to wait given our belief that pricing could improve over time. That has made for both growing cash levels and a growing watch list of investible ideas. If the volatility that we have seen recently continues, we’ve got plenty of dry powder to put to work. This last quarter has led to a material amount of activity and we’re excited about the improving future opportunity set.

All you have to do is turn on the TV or open the paper to see why I’m confident that volatility will present future opportunities. The world looks to be undergoing large shifts that are bound to represent risks to some businesses and opportunities for others. The equity market has been quick to react but volatility is just starting to show up in credit markets. Do you have the conviction to bet that the next five years will be uneventful? I certainly don’t. Your portfolio should welcome more volatile times, as our Portfolios certainly do.

Certainty is rare in investing but the one area where I’m confident is our likelihood of making mistakes over the next five years. We have had our fair share of mistakes in the past and I am confident we will make more in the future. Not every decision we make will be additive to our returns, and our mistakes will detract from our future performance. I sleep well at night knowing that our decision making is grounded in a time-tested investment approach and our track record since inception illustrates a repeatable approach to risk management and minimizing our mistakes. Know that while we can’t responsibly eliminate all mistakes, we are aligned with you in our outlook and have substantial amounts of our personal capital invested alongside you. Our long-term track record includes our past mistakes and we feel confident that our future returns will continue to have significantly more winners than losing investments.

An optimistic prediction

Using the current YTM of our Portfolios as a market-timing tool and a predictor of future returns hasn’t worked well in the past, and we see no reason why it would do so in the future. Over an appropriate amount of time, we have been able to add value in excess of the yield and our current positioning puts us in a prime position to take advantage of the increased volatility that we’ve been seeing. While we cannot predict what the market will do over the next five years, the odds are on our side that the market will experience bouts of volatility and we’re confident in our ability to take advantage of it. I have confidence that our five-year return can beat the current YTM on the Portfolios and I think the indexes will struggle to do the same.

We’re fortunate to have a lengthy list of clients committed for the long term in our fixed-income Portfolios. We don’t know how to time the market within our Portfolios, and we have yet to see clients try to market time when investing in them. Those who have done best tend to mirror our approach of investing with a five-year view and adding during periods of downward volatility. We think the next five years look bright and welcome the increasing opportunity set that the market is bringing our way.

i As March 31, 2025.

ii The period is March 31, 2020 to March 31, 2025.