I bet the 8 ball didn't see that one coming – 4th quarter, 2025

Enjoyed what you read below and want to hear directly from the author? Investment Team members Frank Mullen and Claire Thornhill discuss their Q4 2025 commentaries with relationship manager Ryan Hatch. They talk about the lessons they've learned, the benefits of our Investment Team's structure and more.

I think it’s fair to say that none of the market prognosticators I talked about in last year’s commentary could have predicted the events of 2025 in their crystal/Magic 8 balls.

It was a year when volatility came back for some short but exciting visits, reminding investors that a sharp decline in their equity funds is never more than one tweet away.

I was lucky enough to be out in B.C. for meetings with our advisor partners in April when the fallout from Liberation Day was at its peak,i so I got to experience the highs and lows of the third-largest volatility spike since the crash of 1987 alongside them.ii And highs and lows they were. I doubt anyone forgets, but the intraday range for the S&P 500 Index during the following week looked like this:

Monday: 8.1%

Tuesday: 7.1%

Wednesday: 10.7%

Thursday: 4.4%

Friday: 3.1%iii

It was a great time to speak with advisors. The same kind of question came up in every meeting: “How do you invest in an environment like this?”

It was the perfect softball question.

Batter up

If you have spent any time on our website, you’ll know that EdgePoint loves volatility. (We love it so much we once wrote a letter to it.) We see volatility as a feature of the market, not a bug to be managed away. Our goal is to be ready to take advantage of it when it appears. We know we can’t predict the future, so we don’t try. Instead, we focus on building on our track record of finding good businesses that can grow without overpaying for that growth.

Not overpaying is often the hardest part. Even if we think we have a proprietary insight about why a business can be much bigger in the future, we still have price discipline. This means we spend a lot of time waiting patiently for our ideas to come on sale, so we can buy some growth for free.

Volatility makes that part of the job a little easier. The fear that comes with it usually creates some very irrational investor behaviours like panic selling or a “dash for cash”. We try to capitalize on those emotions by buying great businesses from sellers who don’t understand the true value of what they own.

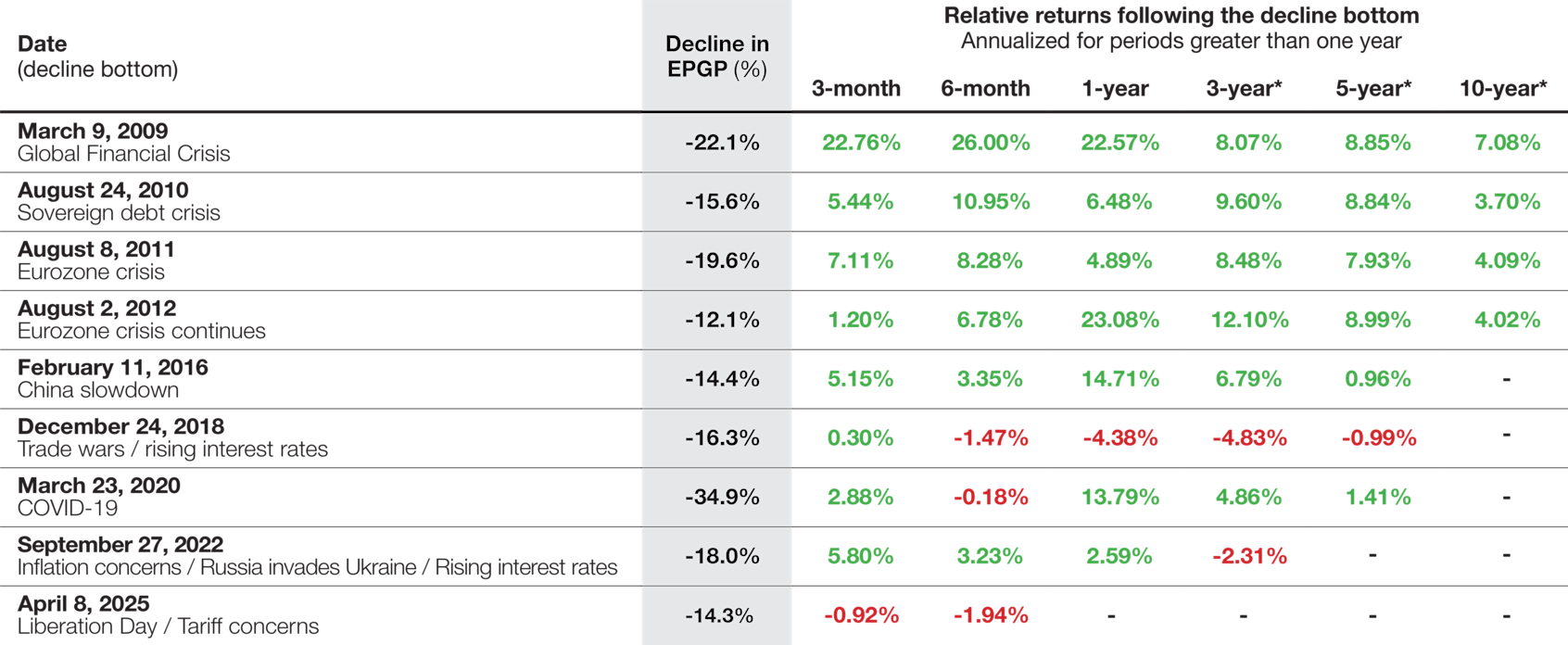

History shows we have a good track record of adding value during periods like this. Following the largest declines in the Global Portfolio’s history, we have outperformed our Global Equity category peers over all 10-year periods and all but one five-year period:

EdgePoint Global Portfolio, Series F (EPGP) vs. the Global Equity category (average)

Annualized relative returns following decline bottoms

*Annualized total returns, net of fees (excluding advisory fees), in C$. As at December 31, 2025

EdgePoint Global Portfolio, Series F – 15-year: 12.09%, 10-year: 9.60%, 5-year: 10.57%, 3-year: 13.49%, 1-year: 17.51%, YTD: 17.51%. Global Equity category (average) – 15-year: 9.66%, 10-year: 9.00%, 5-year: 9.34%, 3-year: 16.47%, 1-year: 12.52%, YTD: 12.52%. Number of funds in the Global Equity category – 15-year: 363, 10-year: 721, 5-year: 1,325, 3-year: 1,592, 1-year: 1,802, YTD: 1,802.

Source: Morningstar Direct. Total returns, net of fees (excluding advisory fees), in C$ and annualized for periods greater than one year. Series F is available to investors in a fee-based/advisory fee arrangement and doesn’t require EdgePoint to incur distribution costs in the form of trailing commissions to dealers. Past performance is not indicative of future returns. See Important information – Global equity category for additional details.

Most rational business owners know that volatility isn’t risk. The day-to-day fluctuations of prices on a screen have very little impact on the true underlying value of a business over the long term. A rational business owner knows that the only true risk they have when it comes to investing is losing their hard-earned money forever.

But that doesn’t mean that volatility is without risk, especially if you don’t know the value of what you own. There are few things in life more terrifying than watching the price of your investment fall when you don’t know what it’s truly worth. That fear can cause all sorts of irrational behaviour that quickly turn a paper loss into a very real loss of capital – the true definition of risk.

Risk management at EdgePoint

At EdgePoint we define risk as the permanent loss of capital, and we spend every day trying to minimize the likelihood of that happening. We believe the best way to do this is by owning businesses that are resilient enough to grow through any kind of macro environment and come out stronger on the other side.

If you asked any of us about the businesses we own in our Portfolios, we’re probably not going to lead with a table-pounding thesis on resilience. We will likely tell you about the big idea – the positive change happening that the market hasn’t priced in yet, what our proprietary insight is and how much bigger we think the business can be when it happens.

That’s the exciting and, ultimately, most important part. We firmly believe the only way you can beat the market sustainably over the long term is to have an idea about a business that isn’t widely held by others. Having that proprietary insight is the most important part of our investment decision – it’s the cornerstone of our approach.

But we also know that we can be wrong. Sometimes the change doesn’t happen or takes way longer to play out than we expected, so we have to be happy with the business we’re left holding when the idea doesn’t play out.

Around the margins

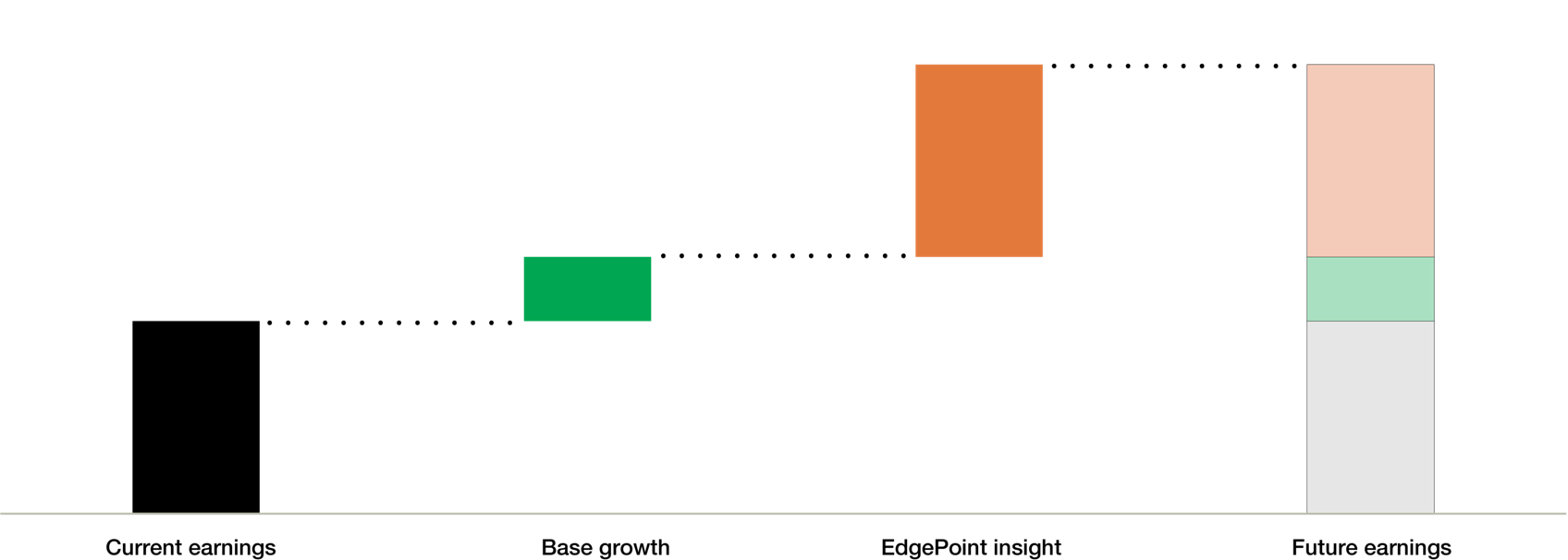

Being comfortable with the base business is our margin of safety if we are wrong about everything else. Let’s walk through three hypothetical scenarios that highlight why we think that margin of safety is so important.

Scenario 1 – Resilient base business, our insight was correct

This is what we hope every EdgePoint investment looks like.

Hypothetical scenario.

The base business grows at a stable rate, combined with our insight about a positive change in the business happening, means that we have a business with significantly higher earnings on the other side.

When we are right about our insight and see something that the rest of the market didn’t, then we end up not having to pay for that growth. The returns we make from these investments should be very attractive and help us get our clients closer to their financial goals.

In this case, the business’ resilience didn’t matter, but not all of our holdings will follow this path.

Scenario 2 – Resilient base business, our insight is taking longer than expected/doesn’t happen

If the base business continues to grow, we should still generate a positive return.

Hypothetical scenario.

To put simple numbers to this:

If earnings were $10 and we paid a 10x multiple for that business, the price would be $100.

If the base business grows 10% during our holding period, earnings are now $11, and if the multiple stays the same at 10x the business is now worth $110.

Even though the insight hasn’t played out yet, we wouldn’t see a permanent loss of capital because of the quality of the business. This gives us time to evaluate if we still think the idea will play out or move on if we think it won’t.

But what if we don’t have a resilient base business?

Scenario 3 – Non-resilient base business, our insight is taking longer than expected/doesn’t happen

These are the situations we are trying to avoid. We need to be happy with what we’re left holding if our insight doesn’t play out. If we don’t, the chance of permanent loss of capital becomes real. When we talk about managing risk, this is the scenario we are talking about:

Hypothetical scenario.

Playing it safe

At an advisor information session last year, Steven Lo and I managed to fill an entire section talking about all the times we thought we had a big idea about a business…that didn’t play out. Don’t worry – this isn’t where the commentary takes a dark turn. There are good stories for investors willing to be patient.

Lincoln Electric Holdings, Inc. is a business we have talked about plenty of times in the past.iv Two years ago, we had a very big idea about the company. In 2021, the Biden Administration had made US$7.5 billion in funding available to build out a public EV-charging network across the U.S. Lincoln Electric, a welding company from Cleveland, was the only company that could produce the chargers that met their strict criteria at scale. It turns out the power module that goes into a welding machine is almost identical to the ones used to power public fast chargers.

The opportunity was massive. If demand was there, Lincoln Electric had the capacity to sell 6,000 chargers in year one for US$100,000 each. To put that in perspective, this was an additional US$600 million of revenue for a company doing less than US$4 billion in sales.

And that was just to start. Once this money started to flow, it could ramp up capacity so quickly that its earnings had the potential to double in two years!

Of course, the money never flowed.

Biden announced a plan to build 500,000 chargers in 2022. By August 2024, eight chargers had been built. The money got tied up in the bureaucracy of state and local departments, and then the new Administration came in and effectively killed the idea of state-funded EV chargers.

So how did the business do?

Lincoln Electric did exactly what it always did. It managed through the uncertainty with the same playbook it has used for the last 100 years. It bought back shares, grew the automation business by acquiring complementary companies, expanded the growth runway in 3D printing by signing long-term contracts with the U.S. Department of Defense to 3D print critical components and continued to deliver margin expansion without needing the revenue from the chargers.

And our investment?

We exited Lincoln Electric earlier in 2025 with an IRR of 17.4%.† Not the decade of double-digit returns we were expecting when we bought the business, but not a bad outcome for a scenario where we didn’t get the hoped-for change.

The margin of safety in the base business meant we didn’t need the change to happen to get a good return.

†† Internal rate of return (IRR) is money-weighted return that accounts for the timing and magnitude of cash flows into an investment and represents an investment’s actual return. The IRR is for Lincoln Electric Holdings, Inc. equity held in Cymbria between January 25, 2023 and November 3, 2025 and in C$.

Annualized total returns, net of fees (excluding advisory fees) , in C$. As at December 31, 2025

EdgePoint Global Portfolio, Series F – Since inception (Nov. 17, 2008): 13.59%, 15-year: 12.09%, 10-year: 9.60%, 5-year: 10.57%, 3-year: 13.49%, 1-year: 17.51%, YTD: 17.51%.

So, what does all that have to do with the volatility in April?

Our margin of safety when we invest is knowing the strength of the base business, projecting how it would do across a wide range of scenarios and having a reasonable estimate for what that business is worth.

This means that when uncertainty strikes and panic kicks in, we have the confidence to buy when every one else is selling. We can capitalize on the mistakes of others and buy great businesses at bargain prices.

The beginning of 2025 was no exception. The volatility from February to mid-April resulted in the third-busiest trading period in EdgePoint Global Portfolio since its inception. The other two times were the Global Financial Crisis and the COVID-19 pandemic.

Over the six weeks after Liberation Day, there was about $2 billion in trading volume for the Global Portfolio (approximately a fifth of assets under management). We were able to buy some businesses on our wish list at bargain prices because they sold off with the broader market such as Thermo Fisher Scientific Inc. (now a 3.6% weight in EdgePoint Global Portfolio).v We also doubled down on existing Portfolio companies that had sold off by more than any change in the underlying business justified (e.g., Roche Holdings AG, Alfa Laval AG) and sold some companies that couldn’t offer the same risk-reward profile as the businesses we were gifted in that short window.vi

Since we launched in 2008, our history tells us that we added a lot of value during volatile periods like this, and our end clients have historically done well with us in the years after them. Our long-term partners are so well-aligned that they did something in April that might have surprised outside observers – at the height of the craziness and market uncertainty, our investors decided to give us more money. On April 9 and 10, the two worst down days in the market, we experienced our largest dollar inflows in EdgePoint history.

In 2026, like every other year, we will continue to work hard every day to maintain that level of trust. We will do everything we can to make sure they can get to their Point B, no matter what new tail risk the market throws at us this year.